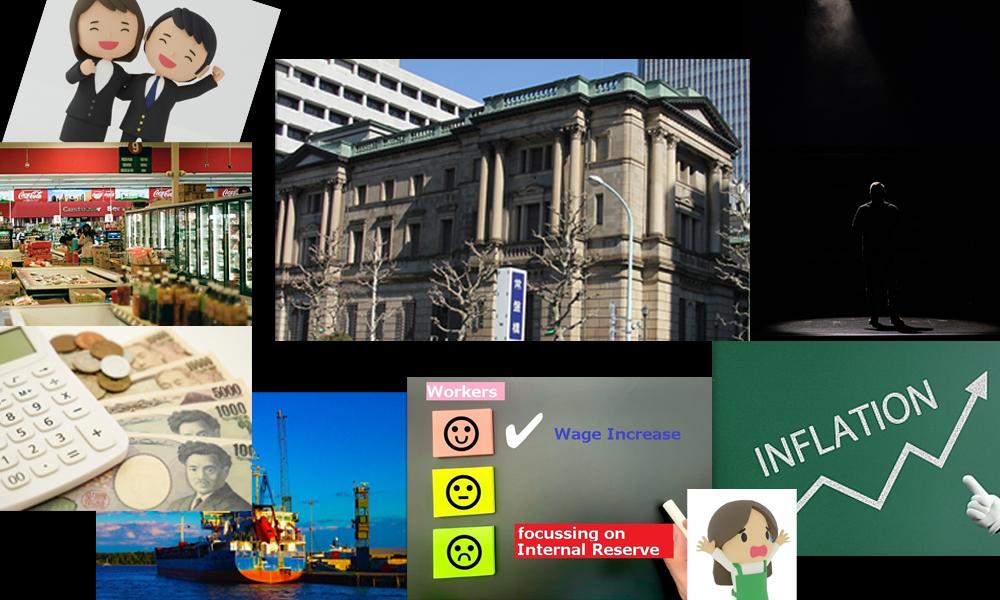

Deep Dive Series 2023: "Banks in crisis - What does it mean for Japan?"

Tohru Sasaki:

Managing Director and Head of Japan Markets Research; JPMorgan Chase Bank, N. A. Tokyo, JPMorgan Securities Japan Co.

Sayuri Shirai:

Professor at the Faculty of Policy Management, Keio University

Jesper Koll:

Leading Japan Strategist/Economist

8:30 - 10:00 a.m. Friday, March 17, 2023

(The speech and Q & A will be in English.)

Governor Haruhiko Kuroda's term as head of the BOJ officially expires on April 8 when nominated head Kazuo Ueda and two new deputy governors will take over leadership of the central bank. Does this imply a situation of "all change" - policy wise as well as in top personnel - or will it be a matter of "steady as she goes?" A lot is at stake, not only for a Japanese economy which has survived over the past decade chiefly with the aid of what critics charge is an artificially low interest rate regime but also for legions of "zombie" Japanese firms kept alive on a diet of low-cost funds. How will Japanese banks and other financial institutions cope in a likely environment of rising interest rates, and what will happen to stock and bond prices once the BoJ reduces its heavy support for these markets?

Deep Dive has secured the expertise of three eminent financial experts and practitioners to explain what the ultimate impact of changes at the BoJ is likely to be. Do not miss the opportunity of hearing them

Tohru Sasaki:

Managing Director and Head of Japan Markets Research with JPMorgan Chase Bank, Tokyo and JPMorgan Securities Japan Co., Ltd.

Prior to joining J.P. Morgan in April 2003, he held several positions with the Bank of Japan, where he had worked since 1992. Sasaki served as a Bank of Japan (BOJ) Representative of the Americas (NY office) between 2000 and 2003 where he was responsible for exchanging market information and views with the Federal Reserve Bank of New York and other U.S. financial authorities. He also worked as a senior trader of the Foreign Exchange division at the BOJ Tokyo office between 1994 and 1997, where his responsibilities included the execution of foreign exchange intervention and the provision of foreign exchange market analysis to senior policymakers. Sasaki began his career in the Research and Statistics Division at the Bank of Japan in 1992 after receiving his B.A. from Sophia University. He is a Chartered Member of the Security Analysts Association of Japan and Chartered Member of the Security Analysts Association of Japan.

Sayuri Shirai:

Professor at the Faculty of Policy Management, Keio University and former member of the Bank of Japan Policy Board.

Professor Shirai is an Advisor for Sustainable Policies at the Asian Development Bank Institute and also an advisor to Nomura Research Centre for Sustainability and Nisshin Oillio Group. Previously, she was a senior advisor to EOS at Federated Hermes located in London in 2020-2021, which provides ESG stewardship services to listed companies. She was a Member of the Policy Board of the Bank of Japan (BOJ) in 2011-2016, which is responsible for making monetary policy decisions. She also taught at Sciences Po in Paris and was an economist at the IMF. She holds a Ph.D. in Economics from Columbia University. She is the author of numerous books and papers on a variety of subjects. The latest book titled “Global Climate Challenges and Finance” will be published in June this year from the Asian Development Bank Institute.

Jesper Koll:

Over the past decades, Jesper Koll has been consistently recognized as one of the top Japan strategists/economists, having worked as Chief Strategist and Head of Research for U.S. investment banks J.P. Morgan and Merrill Lynch. He currently serves as Expert Director for the Monex Group and the Japan Catalyst Fund (Japan’s 1st retail investor based corporate engagement/activist fund). His analysis and insights have earned him a position on several Japanese government and corporate advisory committees and he is an Ambassador for FinCity Tokyo. Jesper serves on the board of directors of OIST (Okinawa Institute of Science & Technology) and Asia Society (Japan). Jesper is an economist, angel-investor, patron; and a "Japan Optimist."

Please indicate when signing up whether you will attend on-line or in-person.

In-person attendance

FCCJ Members: 450 yen (including tax), coffee or tea included

Non-members: 1,650 yen (including tax), coffee or tea included

Online attendance (via Zoom):

FCCJ Members: free of charge

Non-members: 550 yen per person (including tax)

Details on how to join online will be sent to individual emails by 3 PM, Wednesday, March 15.

Non-members and FCCJ members can reserve at the reception desk only by email front@fccj.or.jp

Members should Log in to confirm attendance.

Payment by Non-members must be made in advance by 3PM, Tuesday, March 14.

No refund is available unless the event is cancelled by FCCJ.

Member reservations cancelled less than 24 hours before the event will be charged in full.

We kindly ask for your cooperation with Covid-19 prevention measures at the reception and to wear a mask in the premises.

Thank you.

Professional Events Task Force