Issue:

July 2024

Peter McGill guides us through the options facing Japan’s central bank, depopulation business opportunities and groundless fears over artificial intelligence

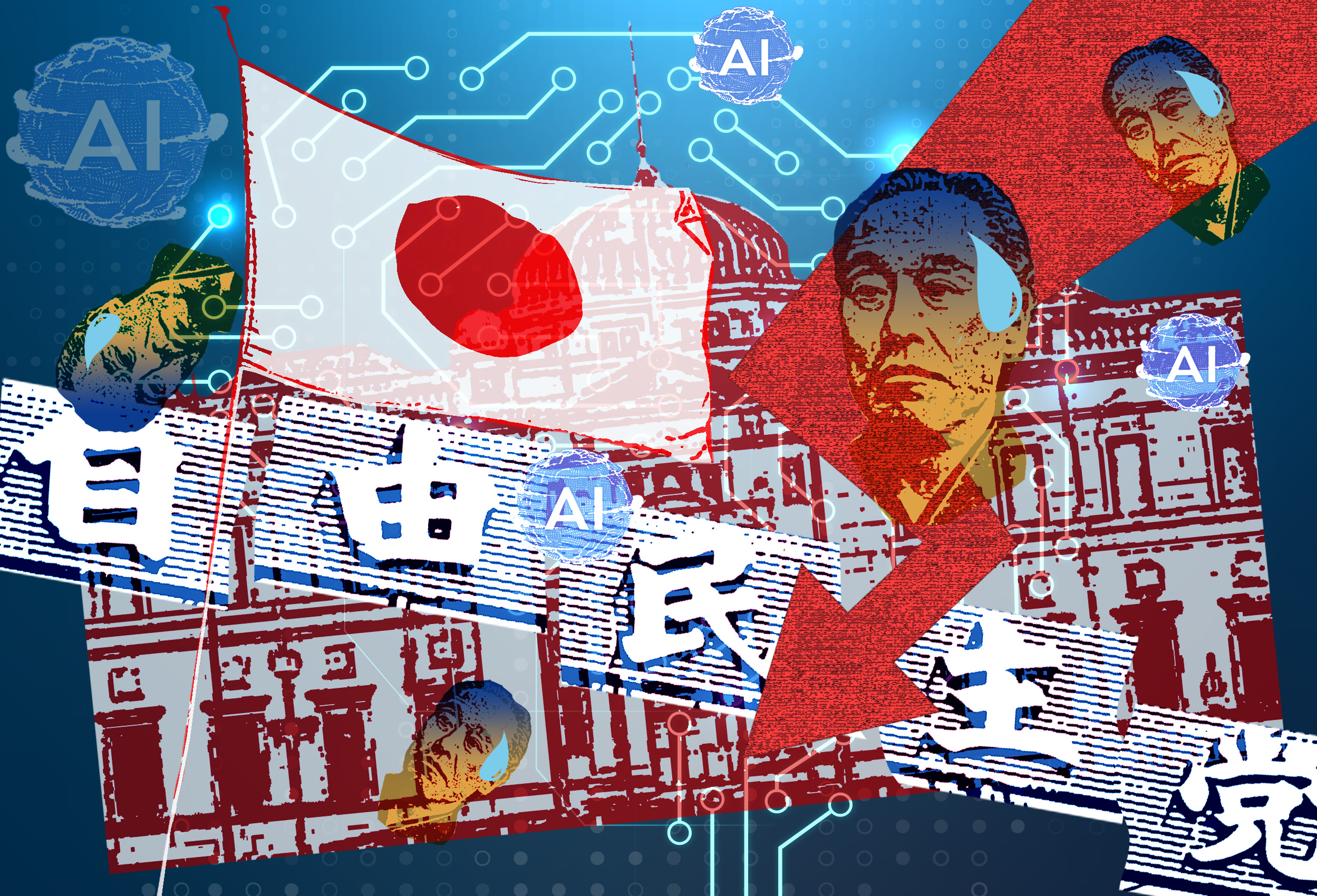

What is the biggest political issue for Japanese? Is it (A) the funding scandal in the Liberal Democratic Party that has so preoccupied Japanese politicians and political reporters? Or (B), declining living standards, encapsulated in the gripe one often hears from ordinary Japanese that they have not received a pay rise in 30 years?

The answer seems to me pretty clear.

“Money politics” is nothing new in Japan. It has infested the ruling party ever since its founding in 1955. This latest manifestation, in which LDP factions were found to have raised at least ¥950 million in unreported income, pales beside what the likes of Nobusuke Kishi, Banboku Ono, Kakuei Tanaka and Shin Kanemaru used to get up to.

Mass poverty, on the other hand, is what Japanese believed they had firmly left behind with postwar reconstruction, yet now Japan’s poverty rate among the working-age population is among the highest in the OECD. The earnings decline is linked to the spread of non-regular employment to 40% of the workforce. Young Japanese find it hard to get well-paid work while job insecurity haunts the middle-aged. More than half of Japanese aged between 65 and 69, and more than third of those between 70 and 74, are still working to supplement pensions that fail to cover subsistence.

In stark contrast, a booming stock market and rising property prices have disproportionately benefited Japanese who were already wealthy. The wealth gap began to widen significantly under Abenomics, the signature economic policies of Shinzo Abe, which had the effect of inflating the value of financial assets. This was a consequence of extreme monetary easing by the Bank of Japan under Governor Haruhiko Kuroda. The idea behind buying up vast quantities of Japanese government bonds (JGBs) was to drive the main interest rate to below zero. A tidal wave of ultra-cheap money would supposedly buoy the economy out of its slough of deflationary despond and revive the animal spirits of cash-hoarding Japanese businesses and investors who were shunning Japanese equities.

Although vehemently denied by Kuroda, another crucial aim was to drive the yen lower, which had skyrocketed as Japanese insurers and other corporations repatriated cash – exchanging their foreign-denominated holdings for yen – to pay for the cost of the 2011 earthquake and tsunami.

The yen duly fell thanks to interest-rate arbitrage. Hedge funds and other financial institutions, foreign and Japanese, borrowed yen for almost nothing and sold it for dollars or other currencies that offered much higher bond yields.

This “yen carry trade” is the principal cause of the yen’s slide to a 37-year low in June. With the BoJ’s short-term interest rate at between 0 and 0.1%, the temptation for investors to fill their boots with yen to buy high-yielding foreign bonds has proved irresistible. In the U.S., the federal funds rate is now 5.33%.

For foreigners, the cheap yen, rising corporate profits and a raft of shareholder-friendly reforms have turned Japan from an investment graveyard into El Dorado. The Nikkei Keizai Shimbun reported that share buybacks for the January-May period had risen 60% on year to an all-time high of ¥9 trillion, equivalent to about a fifth of total net profits for the fiscal year to March 31. Buybacks reward existing shareholders, including executives for whom share entitlements can be an important element of their compensation, by boosting the share price. Critics of buybacks say the spare cash should be more productively spent on capital investment, especially when it would benefit the local economy.

The other alternative would be to just sit on the money. ‘Corporate Japan is grappling with the question of how to use its roughly ¥106 trillion cash in hand,’ the Nikkei said in June. Plus ça change. Japan’s corporate cash mountain was the subject of a memorable exchange I had with a vice-chairman of the Keidanren back in 2013 …

Japan could tax share buybacks, as the Biden administration has done in the US, as a means of encouraging corporations to invest their hoarded cash, but the LDP is probably too beholden to Keidanren to risk its ire.

Enyasu – a weak yen – boosts the profits of Japanese exporters, though less than before as so much production has moved abroad. It also draws millions of foreign visitors to Japan. The foreign tourist spend is now classed as Japan’s second-largest export industry after automobile manufacturing. Less predictable is the benefit accruing to the sogo shosha. For Mitsubishi Corp, “a ¥1 depreciation boosts its profit by ¥5 billion”, according to the Nikkei.

The drawback of a depreciated currency is its effect on inflation through higher import prices. Some culinary staples risk becoming unaffordable, and there are signs that the squeeze on Japanese household budgets is causing jitters inside government, the LDP and Bank of Japan. For ordinary Japanese, foreign holidays are becoming a distant memory. If the mood of caution deepens and consumers rein-in spending too far the whole decade-long project that began with Abe and Kuroda risks unravelling as deflation returns.

The simplest way to bring down consumer prices would be for the Bank of Japan to raise borrowing rates to nearer the levels of other major central banks. Carry trades would immediately unwind and push up the yen’s value. The yen’s appreciation would be doubly difficult to manage as it would likely prompt Japanese financial institutions to repatriate foreign holdings. The Nikkei Average would doubtless swoon in response to the damage done to Japanese export earnings.

Other fears will be keeping Kuroda’s successor at the Bank of Japan, Kazuo Ueda, awake at night. Japan’s public sector debt amounts to 220% of GDP, the highest of any developed nation. The Finance Ministry estimates that the cost of servicing this debt will rise to ¥29.8 trillion in fiscal 2026 if yields on 10-year JGBs rise to 1.6% (as of writing, the rate is 1.054%) and ¥33.4 trillion if yields rise to 2.6%. On top of that, the Bank of Japan would have to pay out trillions of yen in interest on reserve deposits of Japanese commercial banks. Bloomberg reported in March that reserves at the central bank that paid no interest totalled ¥106.7 trillion, while another ¥79.4 trillion in deposits were earning only 0.1%.

Of all Japan’s long-term problems, none generates more defeatism and lack of imagination than rural depopulation. Thankfully, a few Japanese companies scent an opportunity. KDDI recently bought 50% of convenience store chain Lawson, equalling the share held by Mitsubishi Corp. Lawson has about 14,600 stores across Japan. KDDI has a vision of Lawson stores becoming hubs of social infrastructure, as well as bases for online shopping and drone delivery of goods. Could something similar be a blueprint for remote areas of Japan?

Long before Commodore Perry led his gunboats into Edo Bay, Japanese had recognised the importance of translation from foreign languages. The Tokugawa shogunate would never have closed the country to foreign powers, with the exception of the Dutch and Chinese, had not the propagation of translated Christian doctrine threatened their rule. Moreover, it was mainly through the translating Dutch texts, imported through the Dutch trading post at Dejima, that Japanese first acquired knowledge of Western science, technology, geography and medicine.

In today’s interconnected world, overcoming language barriers has become ever more vital to Japan, feeding an army of professional translators and interpreters.

Surely, therefore, Japan must welcome with open arms the huge advances being made in machine translation that converts text or speech from one language into another.

Through deep-learning techniques used in generative artificial intelligence, translation software has been continuously improving, and can now convert text or spoken words at the twinkling of an eye. Depending on the software is used, the result of written conversion may still require editing to correct errors, add polish or capture nuance, but the heavy-lifting part of the job has been effectively automated. I would not be at all surprised if there already exists on the market software capable of converting entire foreign-language books into passable Japanese, and at lightning speed.

For millennia, language barriers have divided civilisations and cultures. The ancient Greeks referred to all foreigners as bárbaros because to Greek ears, their languages sounded like ‘bar bar.’ This is the onomatopoeic origin of the words barbarity, barbarous and barbarian. Technology is undermining the Tower of Babel of incomprehensible tongues, with the promise of bringing nations closer together. “Mutual understanding”, that dreaded phrase of emollient Japanese PR, could finally be vested with meaning.

Strangely, the prospect of instantaneous multilingual translation has not stirred excitement in Japan. Rather, it has been met with a deafening silence in government, academia and media.

Last year, I joined a webinar hosted by the Foreign Press Centre Japan about media and generative AI, fully expecting machine translation to be part of the discussion. The topic was never mentioned by the panel: Tim Kelly of Reuters Tokyo, Reed Stevenson of Bloomberg Tokyo, Akira Oikawa of the Nikkei, and Kaori Hayashi of the University of Tokyo.

Since then, Japanese editorial writers and commentators have frequently waxed indignant about the dangers posed by AI, while ignoring its vast potential for bridging linguistic divides. The conservative Yomiuri Shimbun, Japan’s most widely read newspaper, ran a whole series critical of developments in generative AI and calling for strict regulation. Its campaign culminated in a joint manifesto with Japan’s largest telecommunications company, NTT, still partly owned by the government.

“If generative AI is allowed to go unchecked, trust in society as a whole may be damaged … in the worst-case scenario, democracy and social order could collapse, resulting in wars,” the two companies warned.

Could this relentless focus on “hallucinations,” “deep fakes” and other diseased outcomes of AI be masking other concerns of those in authority? Could they feel threatened by AI’s ability to empower ordinary citizens to understand what is being said in a babble of foreign tongues? Do they fear losing the power to selectively filter outside voices for domestic consumption?

Peter McGill is a U.K.-based writer. A former Tokyo correspondent of The Observer, he was the youngest-ever president of the FCCJ.